Move Stock. Get Paid. Grow.

A B2B Stock-Now-Pay-Later solution enabling suppliers and distributors to offer flexible payment terms to business merchants across industries.

Shari’a-Compliant Trade Model

Deferred payments under a trading structure

Trusted by Merchants

95% on-time repayments across merchants

Trusted by Merchants

95% on-time repayments across merchants

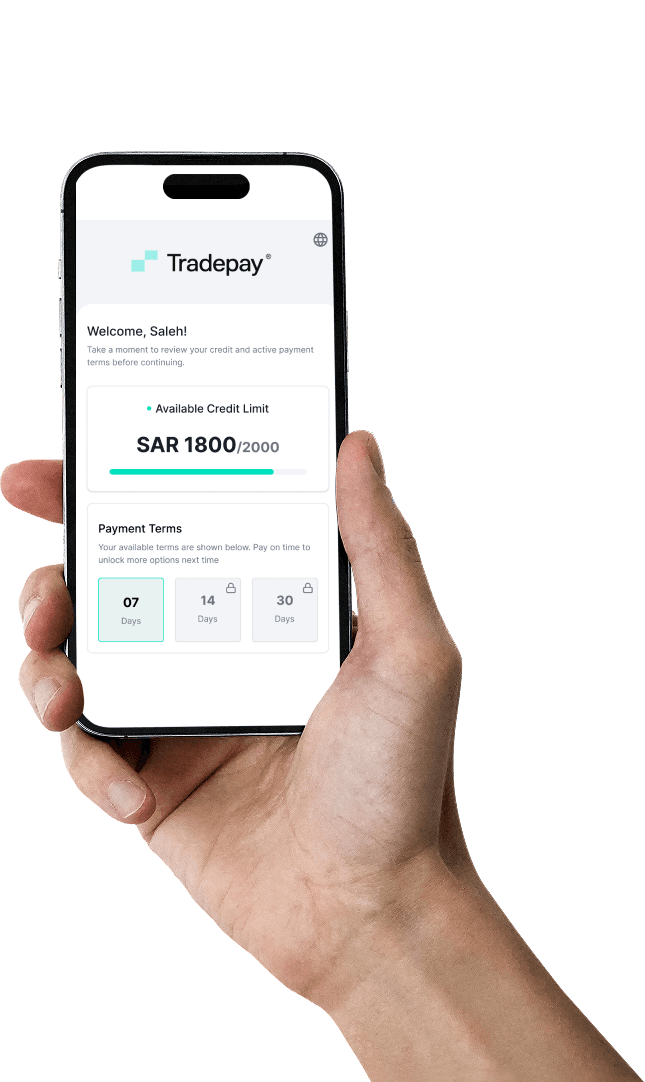

Smarter payment terms for everyday trade

Tradepay helps merchants manage cash flow by offering flexible payment terms on everyday purchases. Stock up from your suppliers, sell with confidence, and repay on agreed terms. All through a simple, transparent platform.

Smarter payment terms for everyday trade

Tradepay helps merchants manage cash flow by offering flexible payment terms on everyday purchases. Stock up from your suppliers, sell with confidence, and repay on agreed terms. All through a simple, transparent platform.

Built for Traditional Trade

Tradepay supports traditional trade by enabling principals, suppliers, and distributors across industries to offer flexible payment terms to merchants, improving liquidity and enabling sustainable growth.

Flexible Payment Terms

Suppliers can offer merchants deferred payment options on everyday stock.

Flexible Payment Terms

Suppliers can offer merchants deferred payment options on everyday stock.

Flexible Payment Terms

Suppliers can offer merchants deferred payment options on everyday stock.

Trusted Trade Network

Built for responsible trading with a focus on transparency and on-time repayments.

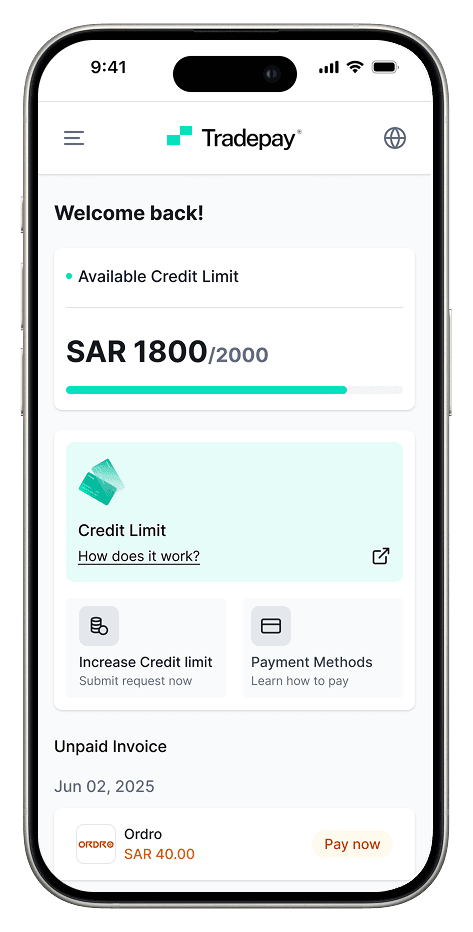

Cash Flow Visibility

Track purchases, repayment schedules, and outstanding balances in one place.

Cash Flow Visibility

Track purchases, repayment schedules, and outstanding balances in one place.

Cash Flow Visibility

Track purchases, repayment schedules, and outstanding balances in one place.

Grow Sales Without Cash-Flow Risk

Tradepay helps principals, suppliers, and distributors increase GMV by offering flexible payment terms while we manage risk and collections.

For Marketplaces

Boost GMV at checkout

Know exactly where your money is going with smart categorization, real-time updates, and easy-to-understand visuals that keep you informed in every step.

Unlock flexible, Shari’a-compliant payment terms

Increase average order size and purchase frequency

Get paid upfront — we manage risk and collections

For Marketplaces

Boost GMV at checkout

Know exactly where your money is going with smart categorization, real-time updates, and easy-to-understand visuals that keep you informed in every step.

Unlock flexible, Shari’a-compliant payment terms

Increase average order size and purchase frequency

Get paid upfront — we manage risk and collections

For For Distributors and Suppliers

Predictable Cash Cleaner Operations

Tradepay enables distributors and suppliers to sell on deferred terms to grocery retailers while giving finance teams control over limits, repayments, and cash visibility, and allowing sales teams to focus on selling, not collecting.

Faster routes, more stops: reps sell, vans move, no cash chasing

Tighter operations: limits, repayments, and escalation in one system

Controlled cash: clear visibility, lower risk

For For Distributors and Suppliers

Predictable Cash Cleaner Operations

Tradepay enables distributors and suppliers to sell on deferred terms to grocery retailers while giving finance teams control over limits, repayments, and cash visibility, and allowing sales teams to focus on selling, not collecting.

Faster routes, more stops: reps sell, vans move, no cash chasing

Tighter operations: limits, repayments, and escalation in one system

Controlled cash: clear visibility, lower risk

Grow Sales Without Cash-Flow Risk

Tradepay helps principals, suppliers, and distributors increase GMV by offering flexible payment terms while we manage risk and collections.

For Marketplaces

Boost GMV at checkout

Know exactly where your money is going with smart categorization, real-time updates, and easy-to-understand visuals that keep you informed in every step.

Unlock flexible, Shari’a-compliant payment terms

Increase average order size and purchase frequency

Get paid upfront — we manage risk and collections

For For Distributors and Suppliers

Predictable Cash Cleaner Operations

Tradepay enables distributors and suppliers to sell on deferred terms to grocery retailers while giving finance teams control over limits, repayments, and cash visibility, and allowing sales teams to focus on selling, not collecting.

Faster routes, more stops: reps sell, vans move, no cash chasing

Tighter operations: limits, repayments, and escalation in one system

Controlled cash: clear visibility, lower risk

How Tradepay Works

Tradepay is embedded directly into existing sales and ordering workflows — no new systems, no disruption.

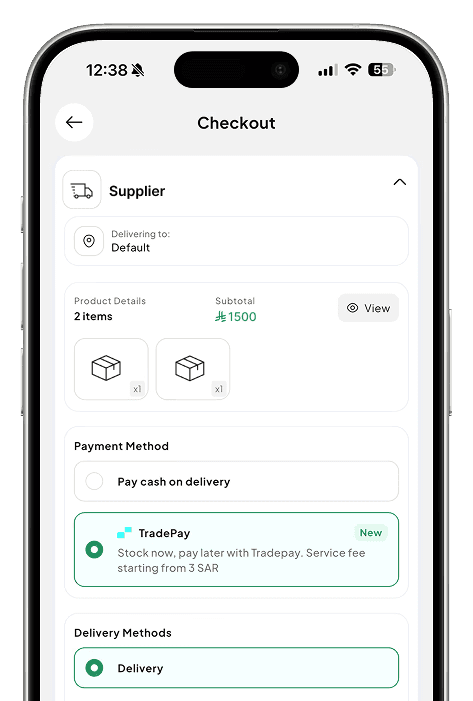

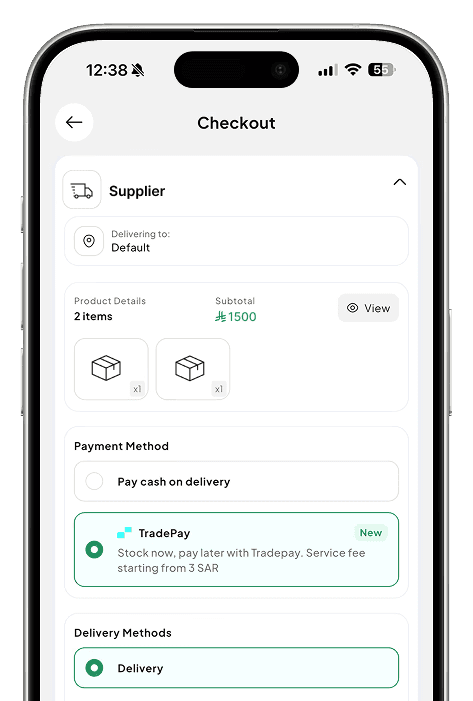

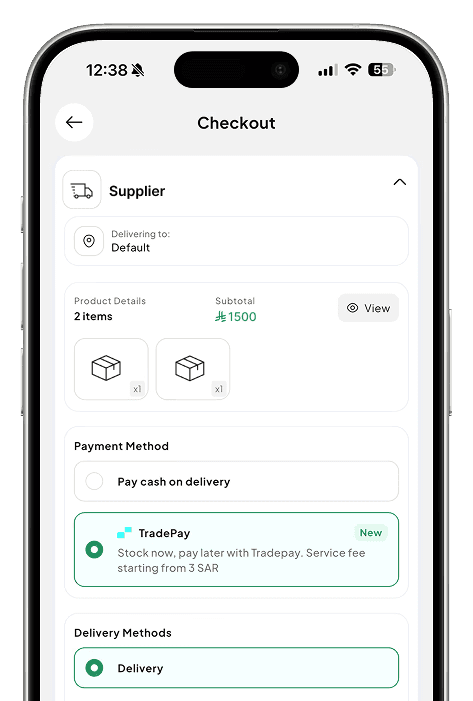

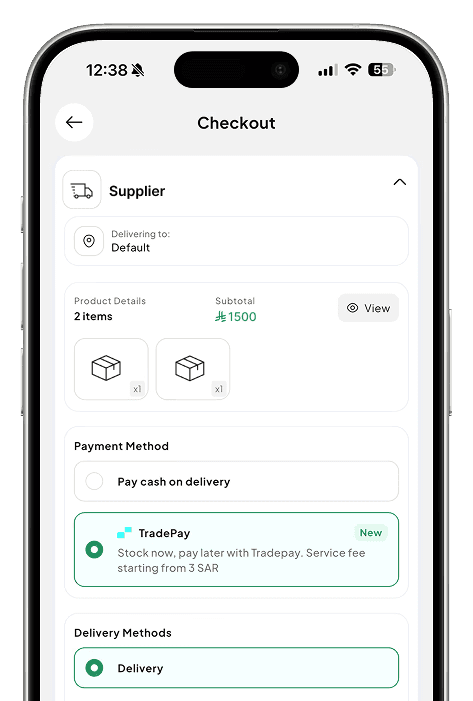

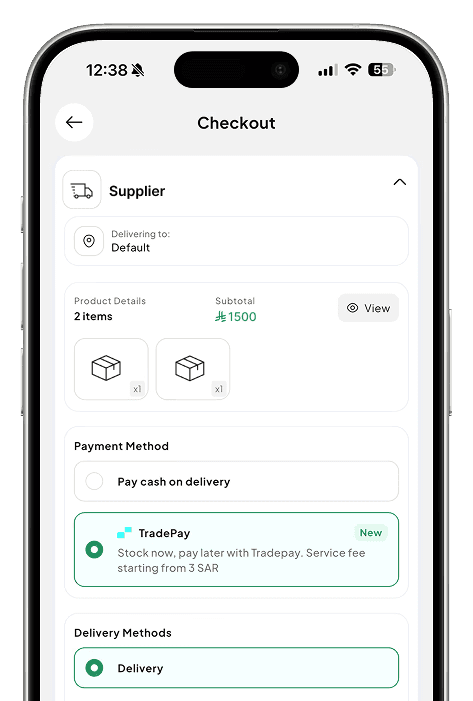

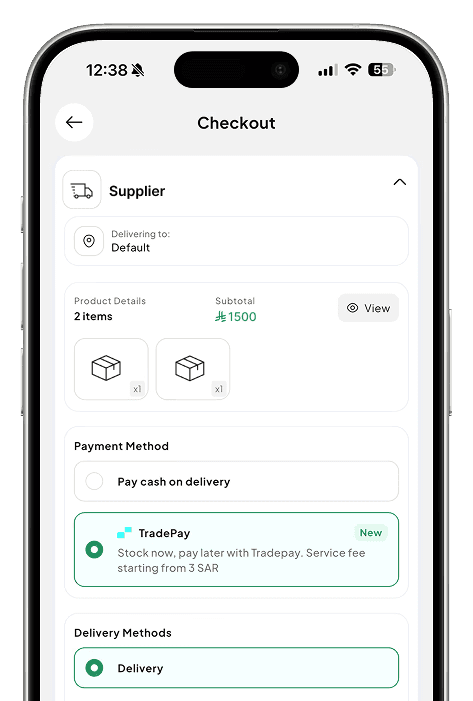

Step 1: Tradepay is embedded where trade happens

Tradepay integrates into SFA devices, distributor ordering tools, and B2B marketplaces.

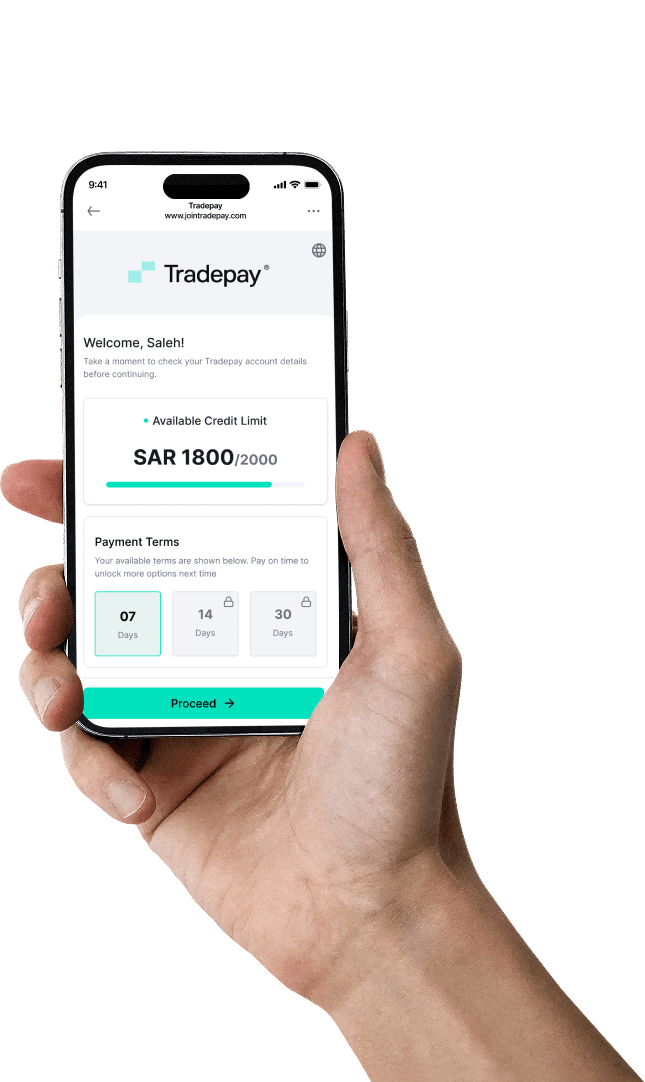

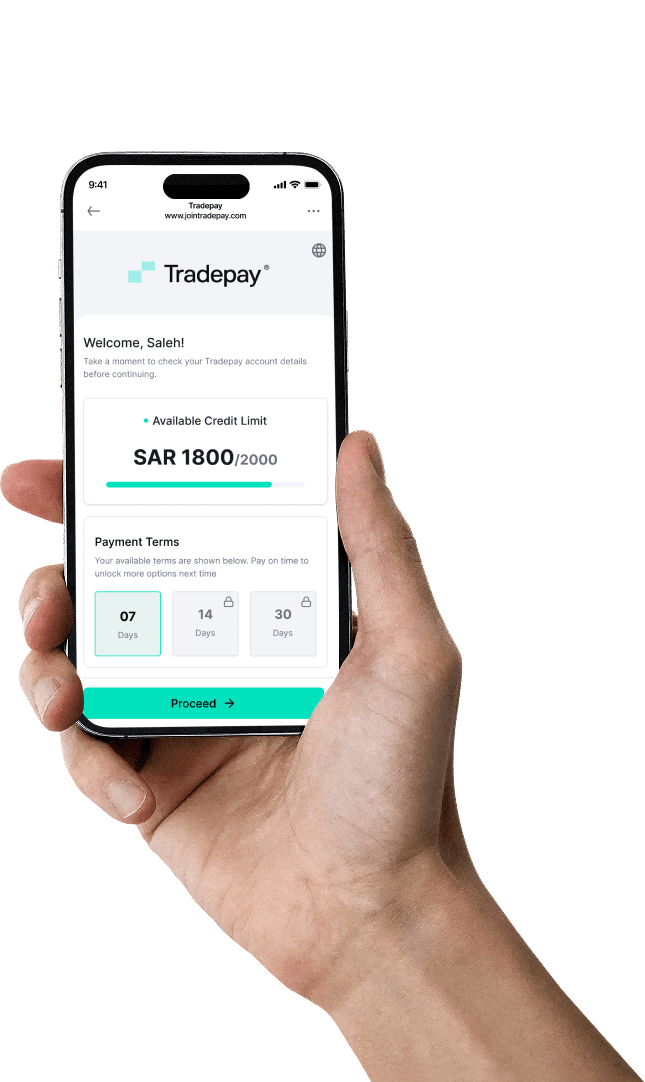

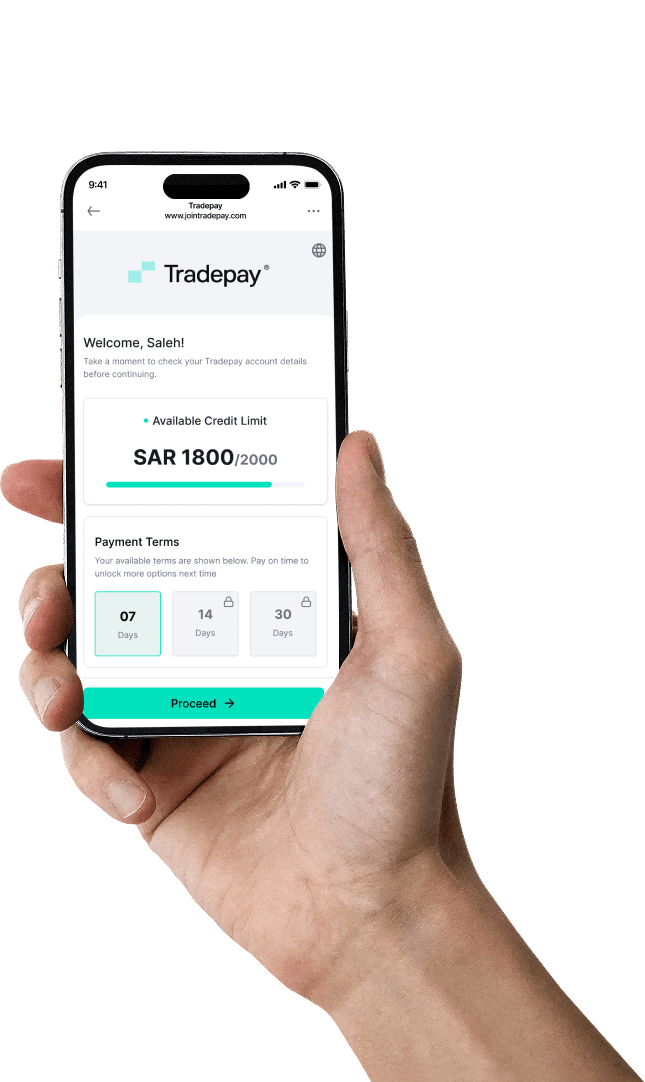

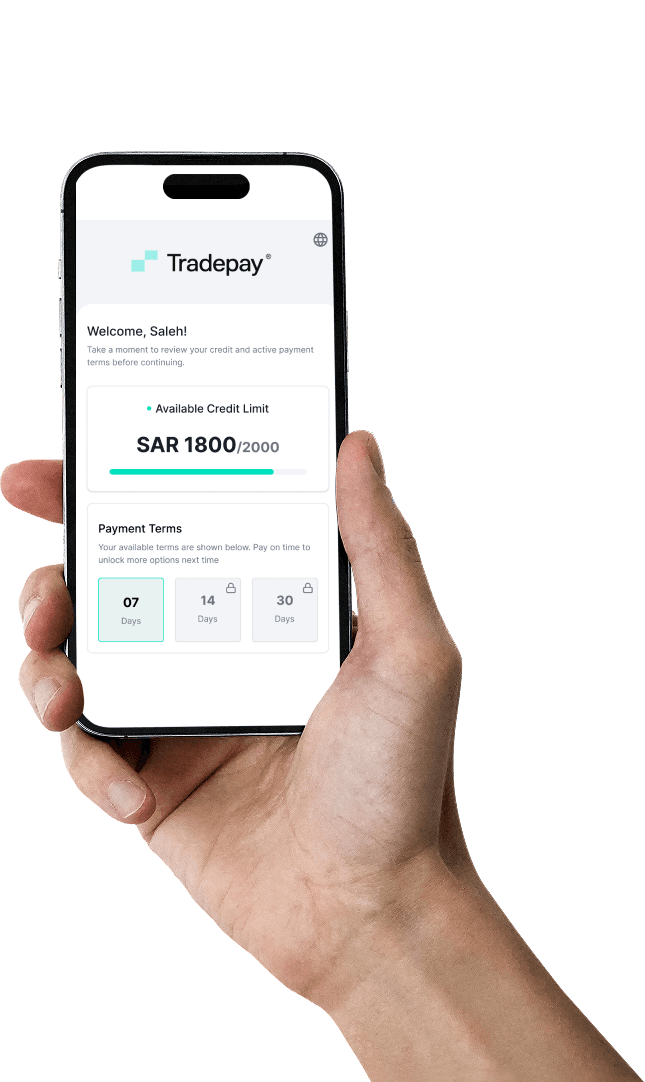

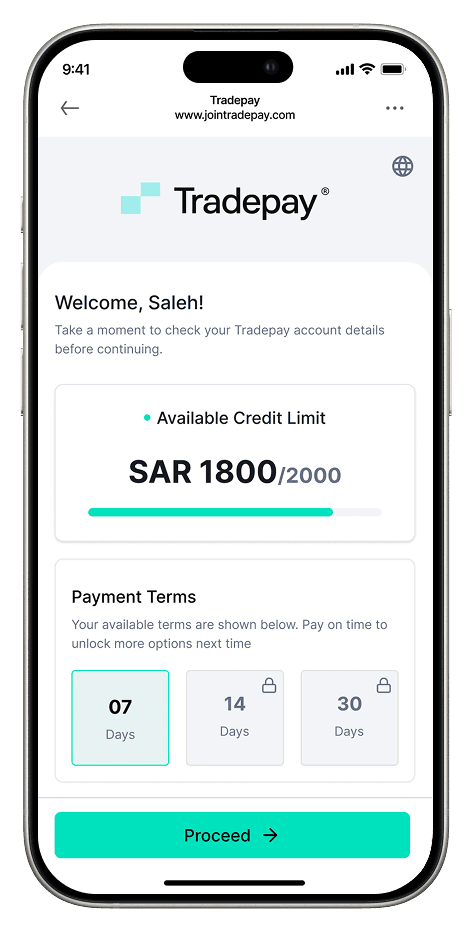

Step 2: Merchants select Tradepay at checkout

Merchants choose Tradepay as their payment method and view available terms based on their limit.

Step 3: Tradepay settles upfront and manages the rest

Suppliers get paid immediately. Tradepay handles credit limits, repayments, reminders, and collections end to end.

How Tradepay Works

Tradepay is embedded directly into existing sales and ordering workflows — no new systems, no disruption.

Step 1: Tradepay is embedded where trade happens

Tradepay integrates into SFA devices, distributor ordering tools, and B2B marketplaces.

Step 2: Merchants select Tradepay at checkout

Merchants choose Tradepay as their payment method and view available terms based on their limit.

Step 3: Tradepay settles upfront and manages the rest

Suppliers get paid immediately. Tradepay handles credit limits, repayments, reminders, and collections end to end.

How Tradepay Works

Tradepay is embedded directly into existing sales and ordering workflows — no new systems, no disruption.

Step 1: Tradepay is embedded where trade happens

Tradepay integrates into SFA devices, distributor ordering tools, and B2B marketplaces.

Step 2: Merchants select Tradepay at checkout

Merchants choose Tradepay as their payment method and view available terms based on their limit.

Step 3: Tradepay settles upfront and manages the rest

Suppliers get paid immediately. Tradepay handles credit limits, repayments, reminders, and collections end to end.

Frequently Asked Questions

What is Tradepay?

Who can use Tradepay?

How does Tradepay work?

Is Tradepay Shari’a-compliant?

How are limits decided?

Frequently Asked Questions

What is Tradepay?

Who can use Tradepay?

How does Tradepay work?

Is Tradepay Shari’a-compliant?

How are limits decided?

Frequently Asked Questions

What is Tradepay?

Who can use Tradepay?

How does Tradepay work?

Is Tradepay Shari’a-compliant?

How are limits decided?

Deferred trade, made simple.

Flexible payment terms for suppliers, distributors, and merchants.

Main Pages

Copyright © 2026 Tradepay. All Rights Reserved.